when will capital gains tax rate increase

Mechanics Of The 0 Long-Term Capital Gains Tax Rate The 0 Rate Is Not Unlimited. Short-term one year or less capital gains are taxed at your regular income tax rate.

Pin By Investopedia Blog On Finance Terms Capital Gain What Is Capital Capital Gains Tax

The Capital Gains Tax Calculator by iCalculator is the most comprehensive online calculator for capital gains tax calculations in Australia for both individuals and corporations including small business.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. The 0 long-term capital gains rate was created under the Jobs Growth and Tax Relief Reconciliation Act of 2003 also known as President Bushs second major piece of tax legislation with a delayed implementation of 2008. The calculator allows for quick calculations of Capitals Gains tax which simply requires the asset amount and associated expenses occurred directly as part of acquiring and. With average state taxes and a 38 federal surtax the wealthiest people would pay.

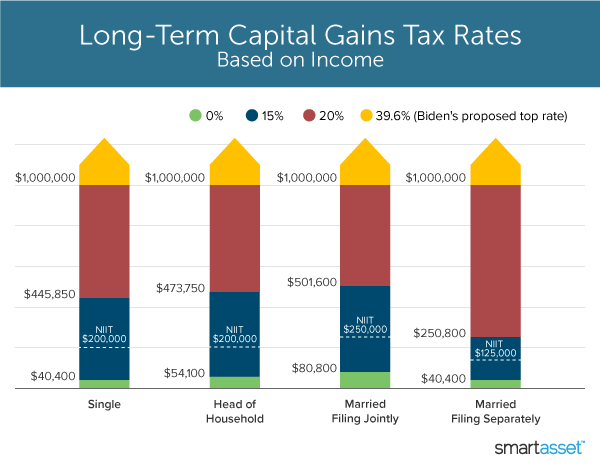

President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. The rule was scheduled to expire with the rest of the. Long-term capital gains are taxed between 0 and 20 with most individuals paying 15.

Capital Gains Definition 2021 Tax Rates And Examples

How Do Billionaires Avoid Estate Taxes Capital Gains Tax Income Tax Tax Consulting

What S In Biden S Capital Gains Tax Plan Smartasset

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)